Executive Summary:

Bitcoin’s Taproot upgrade was implemented on November 14, 2021, to enhance Bitcoin scalability, privacy, and composability. The Taproot upgrade enabled the launch of the Ordinals Protocol, which assigns each satoshi a sequential number; known as Ordinal Theory. Shortly after the Ordinals launch, BRC-20 tokens were developed as an experimental standard built on the Ordinals Protocol. It didn’t take long for network activity to reach 400k pending transactions in the Bitcoin mempool, along with a new all-time-high daily transaction count of 682k, eclipsing the 2017 peak by nearly 40%. As a result of this and for only the fifth time in history, the average fee paid per block surpassed the block subsidy reward. However, the ultimate usage and value of Ordinals and BRC-20 tokens remain uncertain. In Domo’s Gitbook, an online publication about the “BRC-20 experiment” posted on April 4, 2023, the headline says, “Read every word if you decide to test. These will be worthless. Use at your own risk.”

This blog delves into these and other evolutions on top of the Bitcoin protocol. For a more comprehensive understanding of the developments reshaping the landscape of the Bitcoin protocol we invite you to read on.

In an industry with rapid developments and innovations, Bitcoin’s protocol has historically been a monument of stability and consistency. Major upgrades to the Bitcoin protocol have been few and far between.

In November of 2021, Bitcoin officially went through an upgrade that modified the very structure of the Bitcoin blockchain, called Taproot. The Taproot upgrade was implemented to enhance Bitcoin scalability, privacy, and composability (flexible programming options). Taproot was the first upgrade to the Bitcoin blockchain in over four years since Segregated Witness (SegWit) was adopted, ushering in a renaissance of new network activity.

What The Taproot Upgrade Accomplished:

The Taproot upgrade was made up of three different Bitcoin Improvement Proposals (BIPs), which defined three upgrades to the Bitcoin protocol:

- Schnorr (BIP 340):

- This proposal introduced Schnorr signatures, a digital signature scheme that is faster, more secure, and less data-intensive than the ECDSA (Elliptic Curve Digital Signature Algorithm) cryptographic method used previously.

- Taproot (BIP 341):

- Taproot, which the entire upgrade has been called, defined Pay-to-Taproot (P2TR), a new way to send bitcoin that enhances privacy and flexibility for users. It also implemented Merklized Alternative Script Trees (MASTs), which compress complex Bitcoin transactions into a single hash. This reduces transaction fees, minimizes memory usage, and improves Bitcoin’s scalability.

- Tapscript (BIP 342):

- Tapscript is an update to Bitcoin’s original scripting language to enable P2TR transactions leveraging Schnorr signatures improved efficiency and allows for more flexible upgrades moving forward.

Taproot Upgrade as the Launchpad for Ordinals:

Before Taproot, the Bitcoin protocol didn’t allow for much customization. With the Taproot upgrade, the Bitcoin protocol became more flexible. Along with the proposals outlined above, Taproot improved on the SegWit upgrade by eliminating data storage caps in blocks. These implementations set the stage for the creation of Bitcoin Ordinals.

The Ordinals Protocol was created by Bitcoin core contributor Casey Rodarmor (@domodata), which introduced the idea of enabling inscriptions on specific Bitcoin satoshis (or the smallest unit of measure of a Bitcoin). The Ordinals Protocol assigns each satoshi a sequential number, in effect, ordering individual satoshis; hence the name Ordinals. This ordering is known as Ordinal Theory. Once these satoshis are numbered and identified, users can inscribe the sat with any arbitrary data they would like and upload it to the blockchain. This is equivalent to giving Bitcoin the native ability to create non-fungible tokens (NFTs).

The key difference between Ordinals and Ethereum’s ERC-721 NFTs is that the inscriptions do not refer to content off-chain, like IPFS or centralized Web2 servers. Inscriptions data are stored directly on the Bitcoin blockchain.

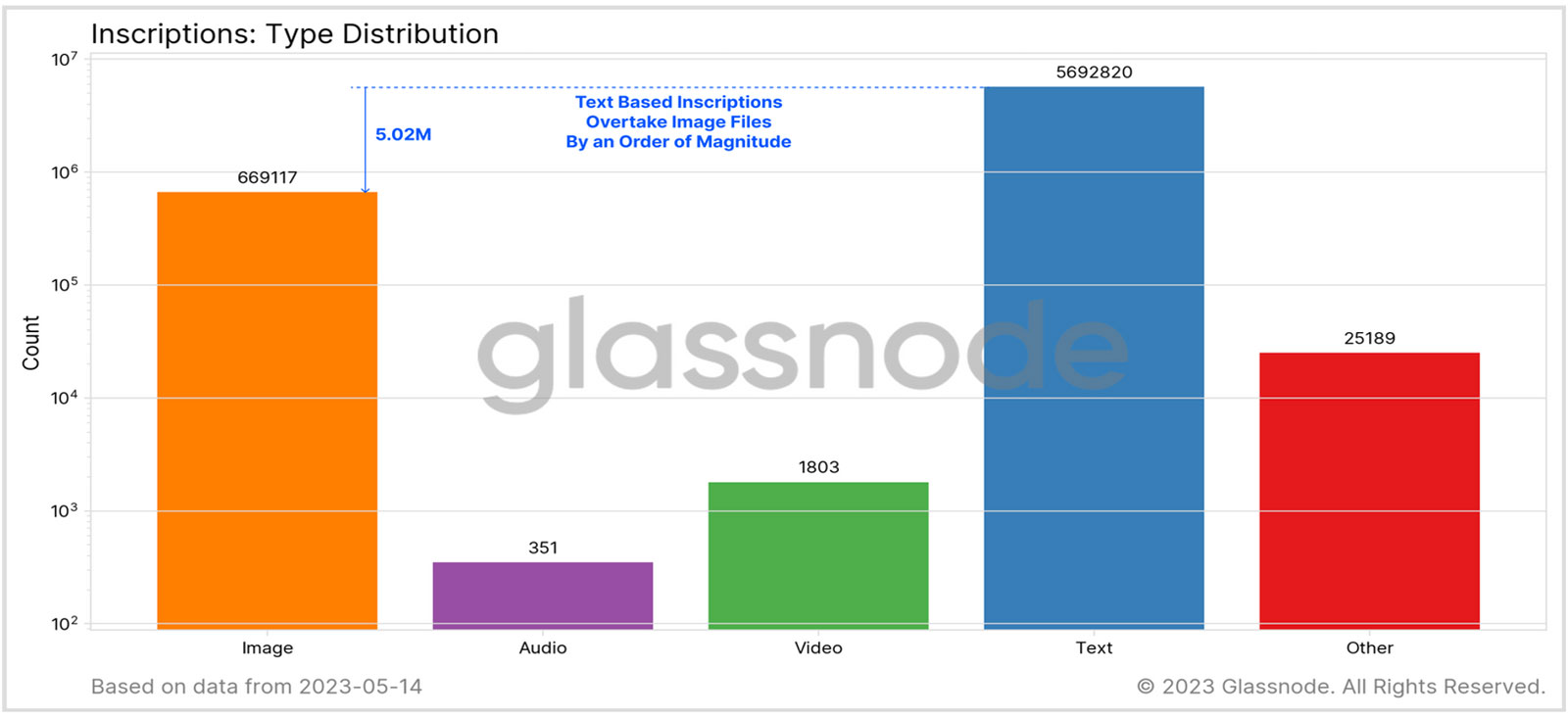

This arbitrary data can be (and has been) almost anything; a playable version of Doom, an Ordinals Punk, and more. See the Glassnode image below showcasing the inscriptions count per different types of data stored; image, audio, video, text, other.

BRC-20 Tokens on the Ordinals Protocol:

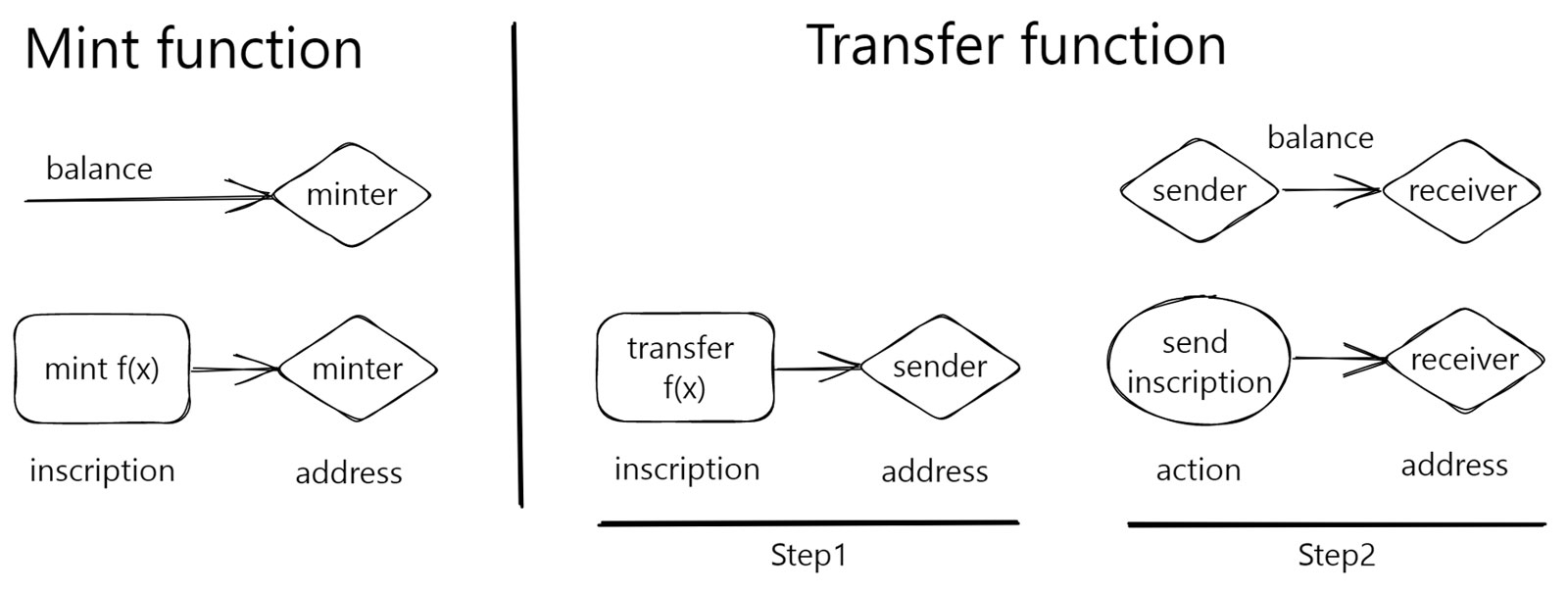

Shortly after the Ordinals launch enabling NFTs on Bitcoin, Casey Rodarmor proposed to use the Ordinals inscription in JSON format to deploy token contracts, coin minting, and transfers; effectively enabling minting of fungible tokens on Bitcoin via the BRC-20 token standard. BRC-20 tokens are an experimental standard built on the Ordinals Protocol intended to provide similar functionality of fungible Ethereum ERC-20 tokens, which have dominated the token issuance space. See the BRC-20 functions below from Domo’s Gitbook.

The first BRC-20 token contract deployed was for the “ordi” token, with a limit of 1,000 tokens per mint and 21,000,000 tokens total (similar to Bitcoin’s supply cap). However, an additional 1.5m “ordi” tokens were minted past the supply cap. To solve the issue of minting tokens past the supply cap, the BRC-20 indexing scheme automatically deems these tokens invalid, making them untradable by any who observes the token standard. Interestingly, the recent popular ERC-20 PEPE meme token (Pepe the Frog) based on Ethereum, was originally inspired by the Bitcoin BRC-20 PEPE.

You can follow the market for the newly created BRC-20 tokens here and here to monitor how the space unfolds.

BRC-20 Tokens Causing Network Congestion:

The development of Ordinals and BRC-20 tokens have brought about an expansion in Bitcoin transactions. With speculators hoping that the Ordinal protocol will be the next big wave of the crypto gold rush, the flood in Ordinal engravings and BRC-20 transfers prompted congestion, and in turn drove up transaction fees.

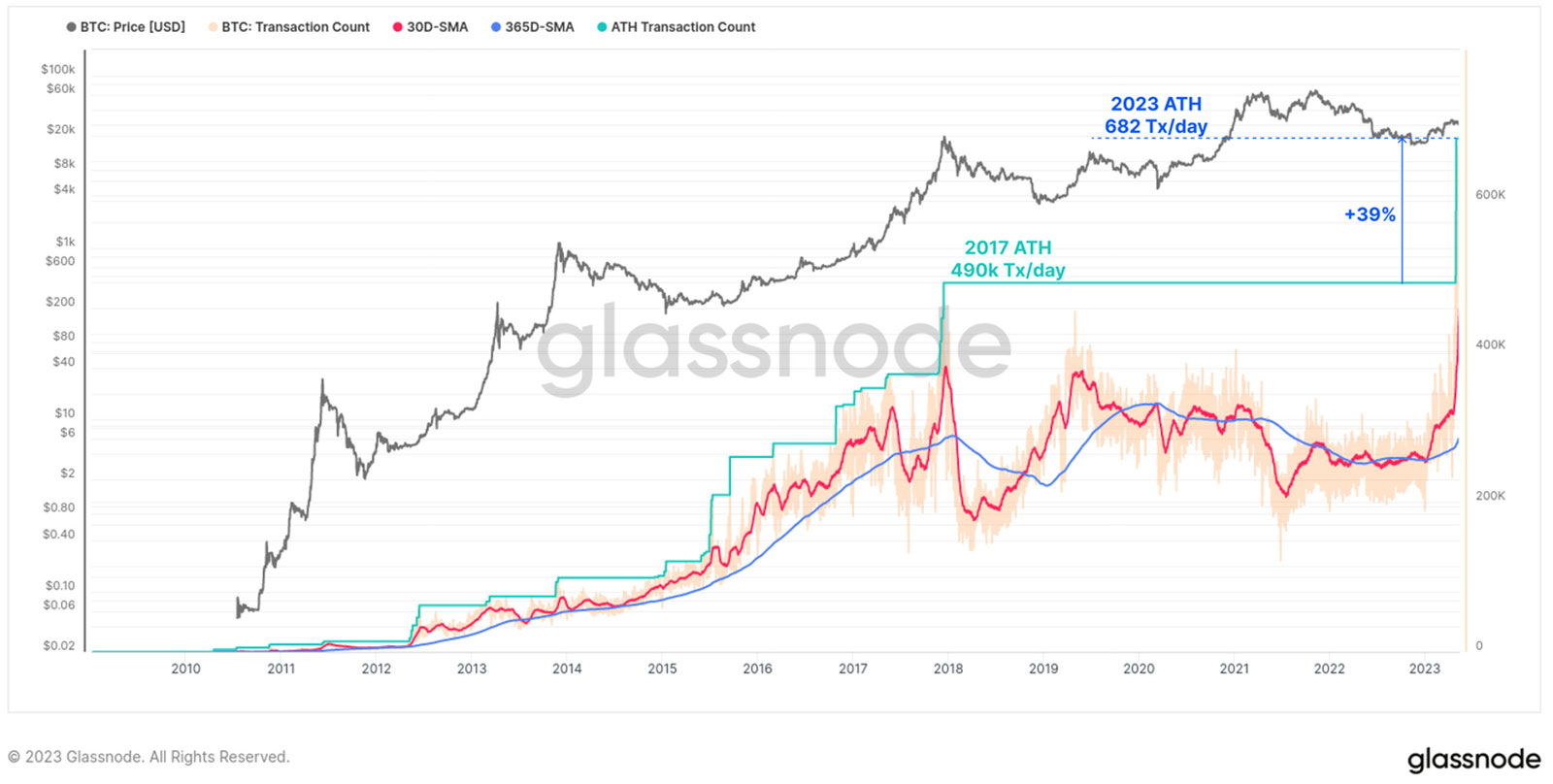

Every transaction that happens on the Bitcoin network, whether it’s sending Bitcoin or transferring BRC-20 tokens, requires confirmation and inclusion by the Bitcoin miners, which consumes network resources. This has led to Bitcoin users willing to pay higher fees to make sure that their transactions are processed quickly, as miners naturally prioritize Bitcoin transactions with the highest fees. This is known as a pay-your-bid auction, in which space in a block (blockspace) is the commodity for sale. When demand for blockspace increases, competition among users tends to drive up the fees needed to transact in a timely fashion. At one point, there were over 400k pending transactions in the Bitcoin mempool, along with a new all-time-high daily transaction count of 682k, eclipsing the 2017 peak by nearly 40%. See Glassnode image below.

Bitcoin: Transaction Count Momentum

During this time, Binance halted Bitcoin transactions due to the congestion and high fees. To mitigate future Bitcoin withdraw backlogs in high fee environments, Binance announced they would begin supporting the Lightning Network, the most widely used bitcoin layer 2 scaling solution, which allows transfers at fractions of the cost.

However, the increase in transaction fees because of the ascent of Ordinals and BRC-20 tokens have offered an extra motivator for miners. With the fixed block rewards set to decrease over time (per Halving events), the rise in transaction fees can help mitigate this reduction and keep miners profitable and incentivized, ultimately increasing the security of the Bitcoin protocol. For only the fifth time in history, the average fee paid per block surpassed the block subsidy reward, with the last instance being at the 2017 market peak, see Glassnode image below.

Bitcoin: Average Fee Paid Per Block

What This Means For The Future of Bitcoin:

The emergence of Ordinals and BRC-20 tokens on the Bitcoin blockchain, facilitated by the Taproot upgrade, represents a monumental milestone in the evolution and development of Bitcoin and offers a fascinating insight into the potential future of the Bitcoin blockchain, beyond its original use case as a “peer-to-peer electronic cash system.”

However, the ultimate usage and value of Ordinals and BRC-20 tokens remain uncertain. In Domo’s Gitbook, the headline says, “Read every word if you decide to test. These will be worthless. Use at your own risk.” Additionally, Bitcoin itself doesn’t have extensive DeFi features, which means moving BRC-20s into Ethereum or alternative L1 DeFi will likely involve bridges and/or wrapping mechanisms, bringing additional security vulnerabilities with it. Additionally, the BRC-20 standard is just a proposal at this point, and there’s no guarantee it will be widely integrated into blockchain infrastructure like wallets and exchanges, although integrations and upgrades to support these innovations are picking up steam.

There are also newer NFT innovations such as the Ordinals Collection Protocol (BRC-721 standard), which is a standard enabling marketplaces to instantly identify Bitcoin NFT collections and reveal metadata directly from the blockchain. In addition to the BRC-20 standard, there are also newer fungible standards like ORC-20 and SRC-20, both aiming to add new features to the BRC-20 standard. Lastly, the Taproot Assets Protocol, formerly the “Taro” protocol, could soon integrate BRC-20 assets into the Lightning Network, aiding the vision of Lightning becoming a multi-asset network with the goal of easing network congestion on the underlying Bitcoin blockchain.

These network innovations are still in their infancy and could potentially redefine our understanding of what can be achieved on top of the Bitcoin network. It will be interesting to pay close attention as the market navigates the technological advances of the Bitcoin protocol and the speculation that tends to accompany such breakthroughs.

About Infotrend:

Infotrend is a team of experienced technology specialists dedicated to helping government agencies modernize, digitize, and innovate. For over 15 years, we have provided solutions that span across multiple domains such as Application Development, Maintenance & Enhancements, Database Design & Administration, Data Analytics & Visualization, Business Intelligence, Outreach & Training Support, Program Management (Agile, Traditional, and Hybrid), Records Management, eDiscovery, and emerging Artificial Intelligence (AI), Blockchain, Digital Assets, and Cryptocurrency. To learn more, please visit https://infotrend.com.