Executive Summary:

Cryptocurrencies and digital assets have been increasingly integrated into the worldwide financial landscape. The need for consistent, comprehensive regulatory statutes is of utmost importance. Nations around the world have taken different approaches to cryptocurrencies and digital assets, from countries emphatically stating that “crypto will never be legalized,” to countries declaring Bitcoin as legal tender. The state of crypto and digital asset regulation oscillates with even more unpredictability than the price of the leading cryptocurrencies. As we enter into this new era of digital assets, a recent initiative by the International Organization of Securities Commissions (IOSCO) has proposed policy recommendations aimed towards providing a global framework for the crypto and digital asset markets. Keep reading as we summarize the proposals set forth by IOSCO and apply them to the latest SEC allegations against Binance and Coinbase. Understanding IOSCOs policy recommendations can help connect the dots about where the industry may be headed next.

What Is IOSCO?

The International Organization of Securities Commissions (IOSCO) is an international body that brings together the world’s financial regulators across the securities and derivatives markets. Established in 1983, IOSCO develops, implements, and promotes adherence to internationally recognized standards for financial regulation. IOSCO’s membership regulates more than 95% of the world’s securities and derivatives markets in over 130 jurisdictions.

IOSCO’s primary role is to assist its members in promoting high quality standards of regulation to ensure fair, efficient, and transparent markets. Additionally, IOSCO’s goals are to protect investors around the world and promote fair and efficient markets. IOSCO works intensively with the G20 and the Financial Stability Board (FSB) on global regulatory reform and to address emerging financial vulnerabilities that could affect global financial stability.

While IOSCO develops its own proposed standards and principles, implementation is dependent on the regulatory frameworks of individual jurisdictions. In other words, each country has its own financial regulators, who are responsible for enforcing their own standards. Therefore, IOSCO’s authority is persuasive and historically important, but not legally binding.

The United States is an active member of IOSCO through two of its most important financial regulatory bodies; the U.S. Securities and Exchange Commission (SEC), which is responsible for overseeing the U.S. securities markets, and the U.S. Commodity Futures Trading Commission (CFTC), which is responsible for overseeing the U.S. derivatives markets. As members of IOSCO, the SEC and the CFTC work hand in hand with regulators from other countries to assist in drafting international standards, share best practices, and collaborate on potential regulatory issues.

Summarizing IOSCO’s Policy Recommendations for Crypto and Digital Asset Markets:

On May 23, 2023, IOSCO unveiled a set of 18 policy recommendations aimed at the digital asset space in a 68-page document. IOSCO structured its report into nine primary chapters, with each chapter addressing key aspects of the digital asset market detailing associated recommendations. Below is a concise summary of the nine chapters and their respective recommendations outlined in the IOSCO report.

Chapter 1: Overarching Recommendation Addressed to All Regulators: This chapter covers universal recommendations addressed to all regulators, which are to establish common standards of regulatory outcomes collectively and to apply or adopt these recommendations in a consistent, outcomes-focused manner. Regulators are encouraged to analyze the applicability and adequacy of their regulatory frameworks, and the extent to which (1) crypto-assets are, or behave like substitutes for, regulated traditional financial instruments, and (2) investors have substituted other traditional financial instrument investment activities with crypto-asset investment activities. These principles serve as the foundation for the subsequent, more specific recommendations onward.

Chapter 2: Recommendations on Governance and Disclosure of Conflicts: This chapter details organizational governance and the disclosure of role, capacity, and trading conflicts. Many crypto-asset service providers (CASPs) typically engage in multiple functions and activities under ‘one roof,’ including exchange services operating a trading venue, brokerage, market-making, and other proprietary trading. CASPs are known to simultaneously offer margin trading, custody, settlement, lending, and/or staking under an overarching umbrella platform. Conflicts can arise from engaging in these activities and functions in a vertically integrated manner, whether through a single legal entity or a closely affiliated group of legal entities that are part of a wider group structure.

Chapter 3: Recommendations on Order Handling and Trade Disclosures: This chapter relates to client order handling and the conflicts of interest which may arise from trading intermediaries and market operators. Regulators shall require a CASP to have systems, policies, and procedures to provide for fair and expeditious execution of client orders, and restrictions on front running client orders. Market participants/investors should have access to an appropriate level of pre-trade and post-trade information to promote transparency, price discovery, and competition.

Chapter 4: Recommendations in Relation to Listing of Crypto-Assets and Certain Primary Market Activities: This chapter covers admission to trading (crypto-asset listings and delistings) and management of primary markets conflicts. As crypto-asset trading activities implicate the same concerns as traditional financial markets, initial and ongoing information about crypto-assets and crypto-asset issuers are essential to avoid information asymmetries, to help protect against fraud, and to provide transparency to investors trading crypto-assets. CASPs are known to have both a strong incentive and opportunity to influence the price discovery process, particularly when also acting as a market maker in the relevant crypto-asset. CASPs may have an incentive to promote trading of specific crypto-assets, even if doing so might not be suitable for, or in the best interests, of its clients.

Chapter 5: Recommendations to Address Abusive Behaviors: This chapter addresses issues on market integrity risks, which have been exacerbated by the fragmented, cross-border nature of the crypto-asset market, such as (1) the lack of effective market surveillance, (2) manipulative market practices (including pyramid and Ponzi schemes, ‘pump and dump’ schemes, wash-trading, front-running, etc.), (3) insider dealing and unlawful disclosure of inside information; and (4) fraudulent, misleading, or insufficient disclosure. Regulators shall consider how to assure oversight and verification of ‘on-chain’ and ‘off-chain’ transactions, including those transactions occurring directly on a crypto-asset trading platform through the internal recordkeeping of ownership changes in omnibus accounts.

Chapter 6: Recommendation on Cross-Border Cooperation: This chapter responds to the global character of crypto-assets by detailing the need for IOSCO members to adopt best practices in international enhanced regulatory cooperation to help ensure effective supervision and enforcement across borders. CASPs often structure and present themselves as having little or no visible substantive presence within any jurisdiction, thus exacerbating cross-border supervisory and enforcement challenges that may arise.

Chapter 7: Recommendations on Custody of Client Monies and Assets: This chapter is the densest of them all, covering many recommendations having to do with custody, segregation, and handling of customer funds, disclosures, and safekeeping arrangements, along with reconciliation and independent assurance. CASPs shall maintain accurate and up-to-date records and accounts of client assets with the precise nature, amount, location, and ownership status of client assets. CASPs shall segregate client assets from their proprietary assets and place client assets in trust or in segregated bankruptcy remote accounts. Proper custody is reliant on the strength of a CASP’s policies, procedures, and controls, including the means of access; such as private keys and wallets.

Chapter 8: Recommendation to Address Operational and Technological Risks: This chapter addresses the broad spectrum of operational and technical risks that can arise because of lackluster controls of CASPs. These risks are associated with the underlying distributed ledger technology used for the issuance, trading, and provision of services related to crypto-assets and the deployment of smart contracts, forks, and use of cross-chain bridges.

Chapter 9: Recommendation for Retail Distribution: This chapter focuses on the promotion to retail investors of the trading and holding of crypto-assets, given the relatively high proportion of retail participants directly accessing CASP trading platforms. Regulators shall consider imposing requirements related to suitability and appropriateness assessments, along with evaluating CASP marketing materials and advertisement about crypto-asset trading. Clear, concise, non-technica,l and accurate disclosures shall be provided on the key features and risks related to the crypto-assets and services offered by the CASP, as well as any fee, commission, or incentives it may charge.

Assessing IOSCO’s Recommendations Against SEC’s Binance and Coinbase Lawsuits:

As described above in the summary, the IOSCO guidelines cover a wide range of topics in the crypto and digital asset markets, including the application of already existing securities laws and regulations, secure custody and safekeeping of crypto assets, KYC/AML requirements, market transparency, and international regulatory cooperation to name a few.

The need for crypto and digital assets markets to adapt to the traditional finance market structure is a common theme throughout the report. IOSCO’s primary recommendation to regulators is that they “should seek to achieve regulatory outcomes for investor protection and market integrity that are the same as, or consistent with, those required in traditional financial markets, in order to facilitate a level-playing field between crypto-assets and traditional financial markets and help reduce the risk of regulatory arbitrage.”

In the legacy financial marketplace, different entities manage different functions. A bank might hold our money for safekeeping, while brokerage firms might execute our trades, and we might go to a financial advisor to develop our investment strategy. This separation of responsibilities can offer a form of protection to market participants and help maintain a level of transparency and accountability. As IOSCO voices, the same level of separation does not exist in crypto and digital asset markets. Many CASPs wear multiple hats. They can act as an exchange, wallet, broker dealer, market maker, lender, clearing agent, and as advisors for example. Though one stop shopping can be convenient for customers, it raises “vertical integration” concerns. IOSCO recommends regulators should evaluate whether permitting a CASP to continue to engage in multiple activities in a vertically integrated manner gives rise to conflicts of interest that cannot be mitigated.

The SEC, has shown a keen interest recently in enforcing the principles outlined in the IOSCO report against the crypto space, as evident in its latest cases against both Binance and Coinbase.

On June 5th, 2023 the SEC filed 13 charges against Binance, the world’s largest crypto exchange. Among the charges were allegations that Binance operated unregistered exchanges, broker-dealers, and clearing agencies, which directly align with IOSCO’s principles of warnings against vertically integrated CASPs. The SEC lawsuit against Binance alleges that customer funds were comingled with other business ventures and potentially used for personal expenses. Commingling of customer funds is a clear violation of IOSCO’s policy recommendations; specifically aligned with the “Custody and Safekeeping” recommendation. IOSCO stresses the importance of secure custody and safekeeping of crypto-assets and recommends implementing robust control frameworks to ensure the protection of client assets, including appropriate segregation and safeguarding measures. In other words, client funds should be kept separate from the company’s operational funds and other business ventures. The SEC alleges that by comingling customer funds with other business ventures, Binance is not only risking the security and integrity of these assets, but also undermining investor trust and violating standards of transparency and accountability, which are key principles upheld by IOSCO’s recommendations.

The SEC also alleges that Binance, while publicly claiming that U.S. customers were restricted from transacting on Binance.com, secretly allowed high-value U.S. customers to continue trading on the platform. This lack of transparency and the alleged manipulation of trading controls goes against IOSCO’s principles for ensuring market integrity and client asset protection.

The SEC has also recently brought charges against Coinbase. According to the SEC, Coinbase integrates three roles that are distinct in traditional securities markets – those of brokers, exchanges, and clearing agencies – without having registered with the SEC in any of these capacities, thereby evading mandated disclosure regulations. The SEC claims that Coinbase has been managing customer solicitation, order handling, bid acceptance, and intermediation simultaneously. Again, we see these charges align with IOSCO’s principles of avoiding vertical integration. The SEC also stated Coinbase provides access to crypto-assets that have high risk scores, according to the Crypto Ratings Council (CRC) framework that Coinbase adopted, in membership with various other crypto organizations.

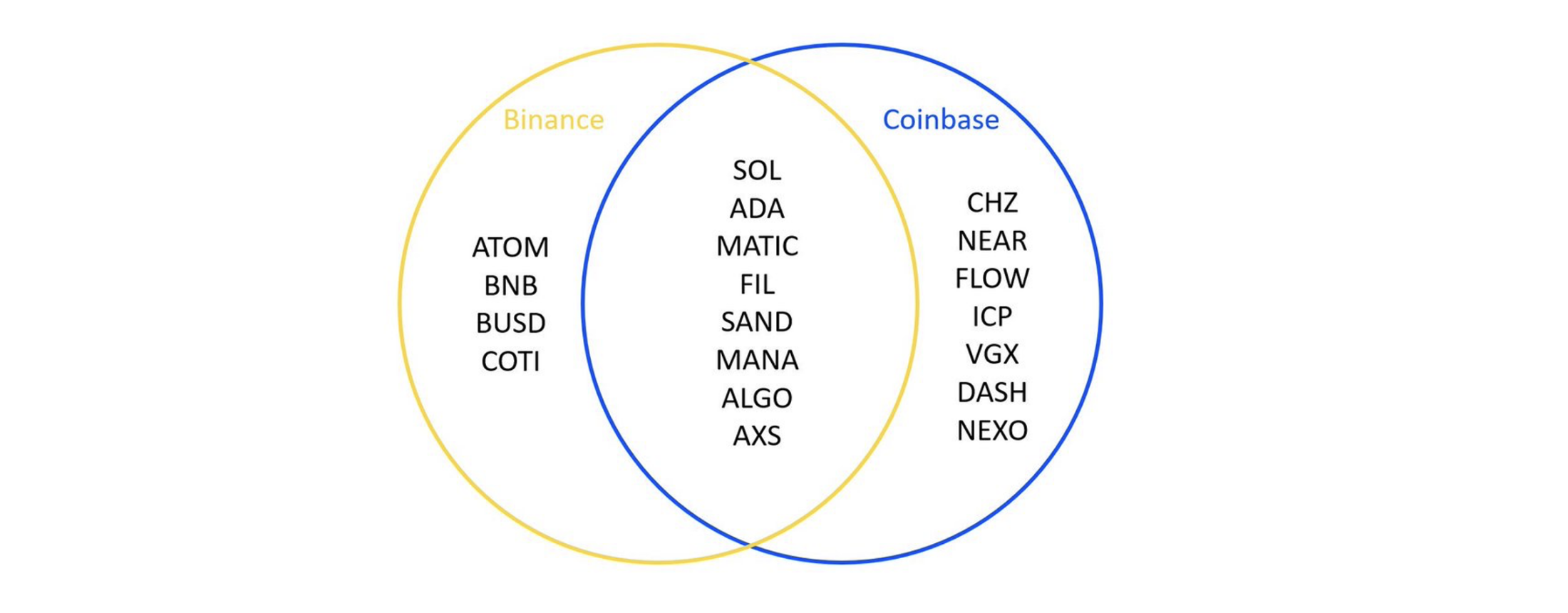

In both the Binance and Coinbase lawsuits, the SEC has alleged 19 crypto-assets listed on both trading platforms violate the Howey Test, with 8 digital assets overlapping, as depicted below.

With its latest lawsuits against Binance and Coinbase, a total of 67 cryptocurrencies are now classified as securities by the SEC (as of the date of this blog post).

The legal standard that is used to determine whether an investment contract is a security or not by the SEC is called the ‘Howey Test,’ which was established by the United States Supreme Court during the case of SEC v. Howey Co. in 1946. The Howey Test serves as the standard to distinguish investment contracts (securities) from other types of contracts. Under the Howey Test, a transaction is a security if it is: 1) an investment of money, 2) in a common enterprise, 3) with an expectation of profits, 4) from the efforts of others. The SEC argues many crypto-assets qualify as securities under the Howey Test. They can argue that an individual typically 1) invests money into a crypto-asset, 2) in a venture where the financial success of the crypto-asset is driven by the team behind the project, 3) with an expectation the crypto-asset will rise in value, 4) from the efforts of the team members.

Conclusion:

While the effectiveness of the IOSCO recommendations will depend on how individual jurisdictions implement them, they have been widely welcomed by industry stakeholders as a valuable framework for developing more robust regulatory practices in the crypto space. IOSCO has opened a public consultation on the outlined recommendations and aims to finalize the recommendations by the end of 2023. After that, IOSCO expects jurisdictions to review their current regulatory frameworks and ensure compliance with these standards to promptly address any gaps. Even though IOSCO’s recommendations aren’t legally binding, the expectation is that regulators worldwide will take them into serious consideration during the formation of their own crypto laws.

Keeping a close eye on the final version of IOSCO’s recommendations following the public consultation period might provide a glimpse into the future crypto and digital asset regulatory statutes. As jurisdictions grapple with the complex and global nature of crypto-assets, the IOSCO recommendations might be a blueprint for regulating this emerging industry to assure a fair marketplace and protect digital asset investors from fraud and abuse. By establishing a framework that can be adopted across jurisdictions, the IOSCO recommendations could play a pivotal role in ensuring that the crypto market operates with the same level of transparency as traditional financial markets.

Disclaimer: This article was written on June 13th, 2023 and any events, developments, or information that may occur after this date are not included in the content of this article. The information contained in this article is accurate as of its publication date and may no longer be up-to-date or relevant in the future.